Lamb Weston Shares Decline Amid Mystery of Early Earnings Report

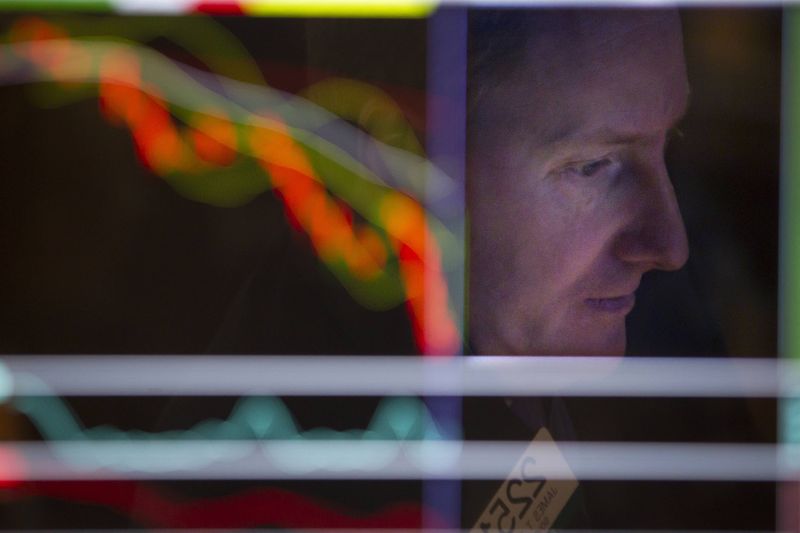

Lamb Weston Holdings, Inc. (NYSE:LW) shares fell 2.75% on Friday due to questions surrounding the company's decision to announce its second quarter results for fiscal year 2025 earlier than usual. Traditionally, Lamb Weston has released its second quarter earnings in the first week of January. However, this year, the company is set to report on Thursday, December 19, 2024. This change in the reporting schedule has raised curiosity, especially given Lamb Weston’s history of being a target for activist investor Jana.

Ahead of the earnings announcement, analysts shared their views on Lamb Weston’s financial outlook. Alexia Howard from Bernstein SocGen Group expressed concerns about potential downward risks to market expectations for the upcoming quarter. Howard anticipates that Lamb Weston’s gross margins could be negatively impacted by higher inventory costs, negative pricing/mix in North America, and a loss of operational leverage. She predicts that the company’s gross margins may decline to 22.4%, in contrast to the consensus estimate of 24.5%. Additionally, Howard forecasts earnings per share (EPS) at $0.86, which is $0.19 lower than the consensus of $1.05.

Robert Moskow from TD Cowen also shared his insights, suggesting a more conservative sales forecast that is 0.5% lower than consensus for fiscal year 2025. Moskow's estimate reflects concerns regarding the extent of market share gains management expects to achieve, falling just below the midpoint of the company’s guidance. He predicts that the second quarter results will align with expectations but believes the 11% consensus expectation for the third quarter may be overly optimistic. Noting that activist pressure could prompt management to enhance performance, Moskow remarked that the anticipated recovery pace could be overly optimistic.

Investors and stakeholders are eagerly awaiting the early earnings report to gain clarity on Lamb Weston’s financial health and future prospects.