How to Create Profitable Portfolios with Ready-Made Strategies?

Stock screeners have become indispensable tools for investors navigating the complexities of financial markets. InvestingPro offers various pre-defined strategies within its stock screener to simplify the process of identifying potential investment opportunities. This guide will help you understand how to effectively utilize these pre-defined strategies.

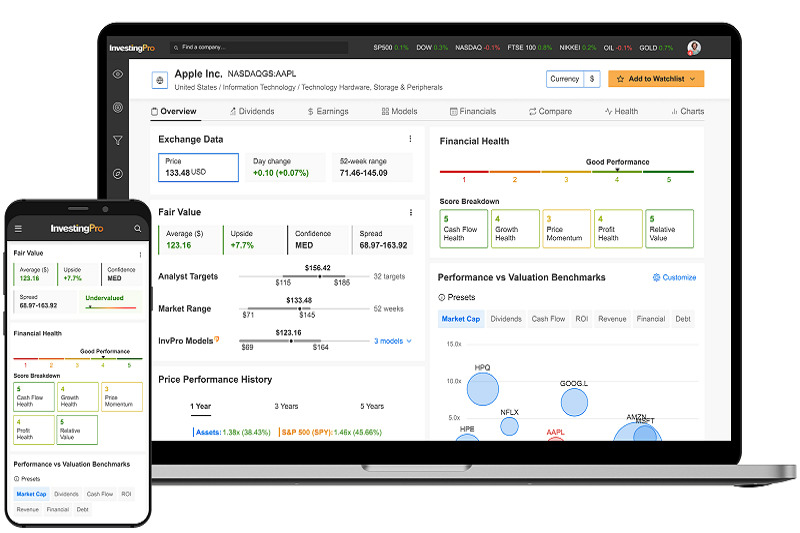

InvestingPro Stock Screener

InvestingPro's stock screener allows investors to filter thousands of stocks and other financial instruments based on specific criteria such as market capitalization, price-to-earnings ratio, and dividend yield. The screener enables users to customize their searches using various metrics. However, for those less familiar with the intricacies of stock analysis, InvestingPro provides pre-defined strategies that can serve as a starting point.

What Are Pre-defined Strategies?

Pre-defined strategies in InvestingPro are screening criteria that align with common investment philosophies or techniques. These strategies are developed based on historical financial data, market conditions, and investment theories. By selecting a pre-defined strategy, investors can quickly narrow down their investment options without the need to manually configure search criteria.

How to Use Pre-defined Strategies?

Access the Screener:

Log into your InvestingPro account and navigate to the screener section.

Explore Pre-defined Strategies:

You will find a list of available pre-defined strategies. Each strategy is described with its main focus and target outcomes, such as growth investing, dividend-focused, or value screening.

Select a Strategy:

Click on a pre-defined strategy that aligns with your investment goals. For example, if you are looking for stocks that may be undervalued, the "Opportunist at 52-Week Lows" strategy may be suitable.

Review the Results:

The screener will display a list of stocks that meet the criteria of the selected strategy. You can further refine the results with additional filters if necessary.

Analyze and Decide:

For each result, you can make informed investment decisions by reviewing the detailed analytics, company profiles, and expert evaluations provided by InvestingPro.

Example: Using the Opportunist at 52-Week Lows Strategy

Let's consider an example of a pre-defined strategy focusing on identifying potential opportunities where stocks are trading at their 52-week lows.

Select the Opportunist at 52-Week Lows Strategy:

Choose the screening strategy labeled "Opportunist at 52-Week Lows" from the list of pre-defined strategies.

Screening Criteria:

This strategy typically involves identifying companies whose current stock price is near its lowest point over the last year. Additionally, it may consider other valuation metrics to ensure that the stocks are not only cheap but fundamentally sound.

Evaluate the Results:

After running the screener, you may find companies that have experienced price drops due to short-term market fluctuations but do not have significant underlying business issues.

Conduct Detailed Analysis:

Perform a thorough analysis for each identified stock to understand the reasons behind the low prices. Examine factors such as recent earnings reports, market conditions, and industry trends. InvestingPro's analytical tools and historical data can help you determine whether these stocks possess genuine potential.

Decision-Making:

Based on your research and financial goals, decide if these stocks align with your risk tolerance and investment strategy. Buying stocks at 52-week lows may offer significant upside potential if the companies recover.

InvestingPro's various pre-defined strategies, such as the "Opportunist at 52-Week Lows," provide a structured approach to identifying potential investment opportunities. These strategies leverage expert insights and pre-defined criteria to simplify the stock selection process, making it easier for investors to discover promising candidates that align with their investment philosophies. As you develop your investment strategy, always remember to conduct thorough research and make decisions considering your individual financial situation. You can now access all these features at up to a 55% discount. Click now to take advantage of this offer.