Aydem Group Sets $3.7 Billion Valuation Target for Energy Unit IPOs in 2025

Aydem Enerji (IS:AYDEM) Yatirimlari AS, one of Turkey's leading electricity producers and distributors, is preparing for the initial public offerings (IPOs) of its two subsidiaries, GDZ Elektrik Dagitim AS and ADM Elektrik Dagitim AS.

The IPOs, planned for the first half of 2025 on the Istanbul Stock Exchange, are expected to value the network operators at approximately $2.2 billion and $1.5 billion, respectively. This statement was made to Bloomberg by Aydem Enerji's General Manager Serdar Marangoz, who was appointed as CEO last month.

The company is in the process of selecting the investment banks that will manage the IPOs, with a decision expected soon. However, Marangoz did not provide details regarding the percentage of shares to be sold or the targeted amount of funds. He expressed optimism about the timing of the IPOs, stating, “If all market conditions are favorable, we could carry out the IPO in the spring.”

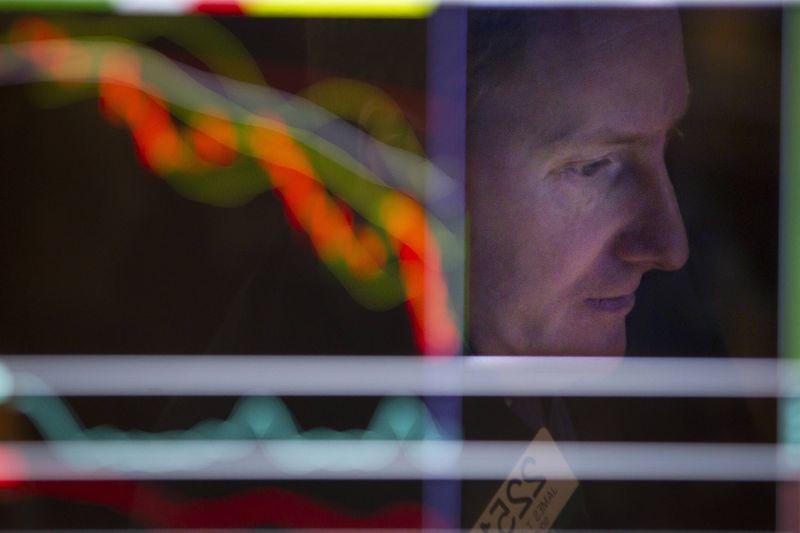

The anticipated public offerings are seen as a positive indicator for the revival of IPO activity in Turkey, especially as the Borsa Istanbul 100 Index shows signs of recovery from prior declines. The Turkish market has witnessed a decrease in the allure of new share offerings due to tightening monetary policy, which has shifted investor preferences toward blue-chip stocks and interest-bearing bank deposits.

The plans for GDZ Dagitim and ADM Dagitim to go public were initially considered in 2018. However, they were postponed following the $4.7 billion loan restructuring of their then-parent company, Bereket Enerji, the following year. Turkey’s electricity market includes 21 privatized electricity networks operating under 30-year concession agreements since the early 2010s.

The proceeds from the IPOs are planned to be used for investments in network infrastructure and debt repayment. GDZ Dagitim, which supplies electricity to 3.9 million customers and holds an 8% share of Turkey’s electricity distribution market, has an annual regulatory investment obligation of about $160 million. ADM Dagitim serves 2.2 million customers and has an annual investment commitment of approximately $120 million. Marangoz noted that GDZ Dagitim is also considering increasing its $400 million bond issuance in October, indicating that ADM Dagitim's IPO may occur first.