Western Digital Faces Challenges as Stock Prices Decline

Western Digital Corp. shares experienced a significant decline, dropping by up to 6.9% during a heightened trading period since August 5. This decrease follows company executives’ predictions at the Barclays 22nd Annual Global Technology Conference that a challenging period is approaching. Management emphasized that the technology sector is in the middle of a cycle, with excess PC and smartphone inventory dampening demand.

According to Western Digital's management, the current quarter is presenting more pricing challenges than anticipated, which may carry over into the next quarter. The impact of these forecasts was also felt by other industry players; shares of Seagate Technology and Micron Technology also fell.

Evercore ISI analyst Amit Daryanani referred to discussions from a competitor conference where CEO David Goeckeler and CFO Wissam Jabre provided updates on trends throughout the quarter. Daryanani noted that the company faced unexpectedly severe pricing challenges for flash storage as the quarter progressed. Nevertheless, Western Digital’s performance for the September quarter exceeded low expectations, especially regarding margins in the NAND business focused on flash storage.

Looking ahead, management is optimistic about a recovery in the PC and smartphone markets, although this is expected to occur closer to the 2025 calendar year. The short-term outlook is more favorable for enterprise SSDs; demand for high-performance storage for tasks such as large language model training is expected to lead these products to constitute a larger share of the company’s flash bit shipments by fiscal year 2025.

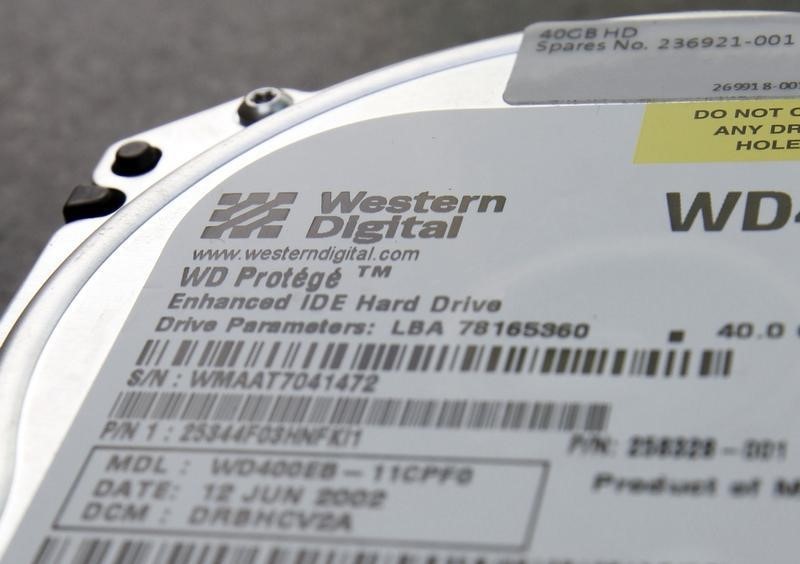

Western Digital also believes that hard disk drives (HDDs) will continue to be the preferred storage solution for bulk data, particularly in hyperscale environments, due to cost advantages. The company is also exploring product innovations and supply chain management strategies to improve HDD margins, which are currently at satisfactory levels.

In summary, despite facing pricing challenges—especially in the flash market—Western Digital is taking steps to manage these issues and remains hopeful for a market recovery in the coming years.